2023, August 3

National Tax Proposal – First Brief Introduction

Introduction

Taxes are part of our lives and they keep the country and the world running. Our tax system however has become incredibly complicated, it employs 80,000 people at IRS, many businesses exist only because of our tax system and it's becoming larger and more complex at all times.

Our proposed National Tax system aims for a different target. The plan is to create efficient, fair and easy to manage tax system for all of us. A tax system that would take a few minutes every year, tax system with absolute fairness for all of us and extremely inexpensive system for the country.

Tax system we would be proud of and other countries would like to copy.

Welcome

We would like to insure you understand that our proposal of National Tax system is made for solid reasons such as simplicity, fairness, time savings and very good financial base. We did not come up with this idea to cut down our taxes and as you will see some folks taxes may go down but for others they may go up.

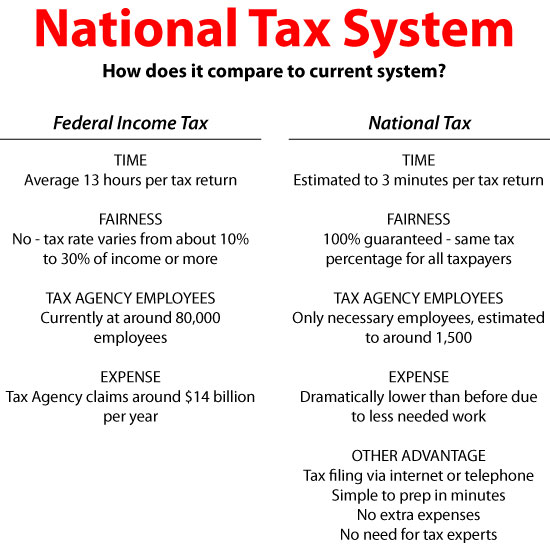

Before you read the rest of our proposal, take a look at these tables below which show numbers of National Tax compared to numbers of current Federal Tax. Other details such as how much time would be saved, how little effort would taxpayers would need and how fair the system is.

Example of Current Federal Tax

Based on Annual Income

Annual Income |

Federal Tax |

Percentage of Income |

|---|---|---|

$10,000 |

$1,000 |

10.00% |

$25,000 |

$2,780 |

11.12% |

$50,000 |

$6,307 |

12.61% |

$75,000 |

$11,807 |

15.74% |

$100,000 |

$17,400 |

17.40% |

$200,000 |

$42,832 |

21.42% |

| $250,000 |

$59,394 |

23.76% |

$500,000 |

$146,894 |

29.38% |

Example of Proposed National Tax

Based on Annual Income

Annual Income |

National Tax (one option would be chosen) |

||

|---|---|---|---|

12% Option |

15% Option |

17% Option |

|

$10,000 |

$1,200 |

$1,500 |

$1,700 |

$25,000 |

$3,000 |

$3,750 |

$4,250 |

$50,000 |

$6,000 |

$7,500 |

$8,500 |

$75,000 |

$9,000 |

$11,250 |

$12,750 |

$100,000 |

$12,000 |

$15,000 |

$17,000 |

$200,000 |

$24,000 |

$30,000 |

$34,000 |

$250,000 |

$30,000 |

$37,500 |

$42,500 |

$500,000 |

$60,000 |

$75,000 |

$85,000 |

Comparison of Current Tax with National Tax

Annual Income |

Federal Tax |

National Tax (15%) |

|---|---|---|

$10,000 |

$1,000 |

$1,500 |

$25,000 |

$2,780 |

$3,750 |

$50,000 |

$6,307 |

$7,500 |

$75,000 |

$11,807 |

$11,250 |

$100,000 |

$17,400 |

$15,000 |

$200,000 |

$42,832 |

$30,000 |

$250,000 |

$59,394 |

$37,500 |

$500,000 |

$146,894 |

$75,000 |

Because this is only a proposal, we have selected 3 different variations of National Tax from 12% to 17% of annual income. In the final approval stage only one percentage would need to be chosen to keep the tax fair for all taxpayers, but for our proposed examples we can offer you a different options.

Shorter Short

Taxes are there and need to be dealt with. We have been involved in theory for a long time and have finally decided to publish our ideas and try to promote it and move it forward.

Our proposal in short includes new National Tax system which would replace the current Federal Tax. The main changes and advantages would be the same tax percentage calculated for everyone, much simpler system to prepare and process taxes, more fairness and better understanding by all taxpayers.

Short Explanation

- Same Tax Percentage is very fair and extremely simple to calculate and to compare. If it for example becomes 15% of annual income, then whoever makes $30,000 per year will be responsible to pay 15% of $30,000 which is $4,500. Whoever makes $60,000 will pay 15% of that annual income, so $9,000. Same percentage.

- Simpler system in this proposal means basically that National Tax will simply care about and collect percentage of annual income from all taxpayers - and that's all. No deductions, complex math, 50 forms, nothing and so very simple.

- Processing of taxes should be incredibly more simple. We propose that the tax returns could be submitted via internet or telephone line and on paper via mail only as the third option. Main check up of each submission would be between taxpayer submissions and submission by their employees, they need to agree. If all is submitted electronically, it will save even more IRS employees from doing their work.

- Fairness is the key in our National Tax system. It is guaranteed, the taxes will not come in touch with any random people, it will be possible to submit it digitally so there will be no mail. It's very safe and without any current risks.

- Understanding will be critical as well. Current tax system has about 800 forms to file and to know. Each form requires IRS description and how-to text creating many possible misunderstandings and possibilities of mistakes. We want to avoid it too, that's also why we propose only 1 form.

National Tax Chances

Does National Tax have a chance to succeed? If it competes only on its own merits, it's clearly very bright, smart and simple system ready to go.

National Tax Numbers

Try to calculate and how does it compare

to current Federal Tax.

Rules are not complex and there are not many, it will be easy to comprehend by most taxpayers and by the collection agency as well. And the current system is hard to maintain - it uses around 80,000 employees, it is not completely fair, different people pay different tax rates, it is too complicated and outdated.

National Tax proposes very simple system with updated features and so it should have a huge chance to be used. Some problem with replacing the current tax system will be that many people or businesses are deeply involved in it and benefit by having some advantages integrated in the current system. We propose to remove them all, the purpose is to have the new National Tax system that will be completely fair and simple to understand for all citizens.

Compare Current Federal Tax with National Tax

What We Have Now?

We have Federal Tax system. It employs about 80,000 people with annual budget of $14.3 billion. It includes about 800 different forms, no internet or telephone tax returns submissions. It does not have fair and same tax rate for every0ne. Many businesses and individuals are integrated in it and so they benefit by maintaining the complexity of the system. Average return takes 13 hours to prepare and send, since we have about 153 million taxpayers we together use about 1,989,000,000 hours, that's about 2 billion hours a year, or 82,875,000 days or 11,839,286 weeks. Every year ... The system is difficult to understand so the deadline to file it is on April 15 of the following year, 104 or 105 days after the year has ended.

We want to change it to make it better, more fair and easy to handle and this is where our proposal starts. Federal Tax may somehow work, but it is very un-american and it needs to be replaced.

Why National Tax?

Taxes are the law and it is the most massive system to collect money for country's common expenses. Our tax system has been in place for a very long time and is now far from perfect. It's very complex, expensive, it employs tremendous number of people and involves many businesses. It has over 800 different forms, 80,000 employees … and the most puzzling of it is the fact that our very progressive and developed country has not done anything to improve or revise it in the long time and instead it constantly makes it more complicated and unpleasant.

National Tax Numbers

Try to calculate and how does it compare

to current Federal Tax.

This proposal would like to be the first serious step to make it better. for the country of for all of us This is only a short overview of National Tax proposal, more will be published later and it will be frequently updated and supplied with more details, numbers, objectives and ideas. We already have a very detailed picture of all the details, but we will be happy to collect more info and advice from all people who want to join.

Tax Introduction and Overview

Tax code is a set of rules and laws to insure the government receives money from its citizens. And the government needs it to run the country, defend it, build it further and support its citizens. Over the years the tax system has become something different in the sense that it is used as a tool to direct its citizens to what they should or should not do.

It is also misused by businesses. When construction companies (and banks) lobbied for some help, the government started mortgage interest tax deduction from tax returns and pushed it on to people with explanation that they are doing it for the benefit to citizens to have better lives. The truth of course was that they did it for construction and financial companies so they can make even more profit. Tax credit sounded good, but it also started public pressure to buy house because “we can now afford it”. And it also gradually increased prices of homes since more people could now afford it. Instead of regular people becoming winners the real number one were construction companies and banks.

There are many other examples with similar results and we will talk about it more when we go into the details. It's simply important to realize that having such complex tax system is generally not good for our citizens, but mostly it's good for companies that convince politicians and then benefit.

Our National Tax proposal is not harsh or designed against something basic. It is not quick fix-it proposal, it has been under the development for a long period of time. It respects the right to have taxes, collect them and to be very fair and much more simple than it is. The overall benefit is to have such system in place where it would benefit to us citizens as well as the country and its government.

Why Not?

Most people don't like to pay taxes. It's expensive, it's mandatory and it's difficult to realize the benefits. It's very complex so responsible citizen needs to learn a lot or hire someone who offers such service.

National Tax Numbers

Try to calculate and how does it compare

to current Federal Tax.

Our country would not be what it is without sound tax collection, we would not have our space flights, no sophisticated road network, airports, train systems, no military safety and much much more. Good and solid tax system needs to be in place in every democratic country and it is important that it is preserved and always being improved. It is also important that such system is very robust, fair for all of us and simple so it lasts and helps us all build our country.

We have reached a level where our tax system is massive and it lost its flexibility, efficiency, fairness and simplicity. It is far too complicated, tough to completely understand its rules and laws. It makes many people to submit returns with mistakes or cheating and that is not good for all of us.

This proposal does not call for new rules to add on top of the existing pile, it calls for the new system that would be radically simple, easy to understand, absolutely fair and with all positive updates a truly robust and smart tool delivering funds to the government.

Benefits

We should start mostly with positive benefits we propose, it's a new idea. There are some disadvantages as in any new tax code system and we will get to those too.

We suggest our National Tax system is known for:

- Simple tax return for all of us – where “simple” means everything is easy to understand for everybody.

- Same fair tax percentage for all people – the system creates no benefits for different people whether they are rich or poor or have a house or 3 children.

- Simple tax return filing – very long overdue, but it is a part of our proposal as well. Get the form and file it without having to look for instructions. You won't need them!

That's a good start! Easy to understand, same tax rate for all of us and very simple tax filing also for all. Those are important qualities mostly directed at individuals who will most likely complete the tax return in 3 minutes. If the benefits seem too few, we have more advantages.

- Less effort to prepare tax return – you won't need a special type of education, you may not even need the help of tax preparation services.

- Faster effort to file taxes – it's now 13 hours per person on average, we aim for a few minutes only.

- Easy tax return check ups – it is important to have solid checking of tax returns of everybody to catch any errors and we have the plan already in place.

- Less IRS employees – currently our country employs about 80,000 people in IRS … to collect and process tax returns – we should be able to do it with much less folks, 80,000 people is a fairly large city.

- Massive saving of time – if it takes on average 13 hours to prepare your tax return, we are doing something very wrong and this needs to change.

- Extreme savings for the country – going for very efficient simplified and fair system sounds very good but also hard to achieve. But when you start going over all benefits for this country and its people, it may be even harder not to achieve it and stay where we are.

- Other countries may copy our system – National Tax system may become very new and very efficient way to conduct part of our country's finances and efforts, but it may also bring our country to become famous (again) for really very good reason.

National Tax Numbers

Try to calculate and how does it compare

to current Federal Tax.

And since we are typing, here are more benefits for the country.

- More fair taxes will bring people closer together, taxes will no longer be dividing us.

- When poorer citizens pay more taxes then now, it will be positive effect, it will direct them to earn more and live with more responsibility.

- Rich citizens will have more difficulty to cheat on their tax returns and they will also become more proud that people get closer together. Plus with the new same tax percentage they may end up paying less taxes.

- Nation will benefit by collecting taxes without much of the usual supervision, less IRS employees will be a huge advantage and having citizens more content will be good for all.

Possible Disadvantages

The current tax system we have now is unfair, very complicated and extremely expensive for the country. Most folks cannot even file their own tax returns and a lot of high earners cheat or skip paying what they are supposed to pay.

But we are a huge country with 330 million citizens including many very smart people so the tax system we have now makes no sense and should be quickly replaced and modified for better and more fair result.

Simple list of possible disadvantages is here. It's important to be straightforward, expect what can happen and be prepared. There are no miracles in tax codes, not even in this one.

- IRS employees need to find more productive jobs – it can be challenging but it will confirm their skills and that the current tax system is useless.

- Tax accountants and attorneys may need to look for other work options.

- Loss of income for businesses supporting tax returns, such as post office and mail, paper suppliers and stores.

- Initial acceptance of tax returns via phone or internet may have a few initial expected glitches, but the benefits are so large that they will be solved very quickly.

- Some politicians may not like it for a short period of time, but others will become our heroes. It's a big change, we need good politicians.

This proposal is simple, fair, bulletproof, helpful for every taxpayer and more than helpful for the country. This proposal is also much less expensive than current forms, it saves all of us together years of our time, because of its simplicity and fast speed of filing. It is very safe and very difficult to submit with incorrect information.

Interestingly enough the paper form is proposed only as the backup and third option to file the taxes with. First possibility would be done over the internet and the second over the telephone.

Completion of the new form is estimated to take about 2 minutes, submission online or over the phone to another minute and that is it - 3 minutes. Taxpayers would not need to educate themselves as to how to complete tax return with up to hundreds of forms. Current tax return takes on average about 13 hours to complete and submit for an average taxpayer today. National Tax would save almost 13 hours for each taxpayer and because we have about 153 million individual taxpayers, it would save us together almost 2 billion hours or about 83 million days of work or 227,055 years. Every year ...

If this was the only benefit of National Tax, I would still go for it. But with other important pluses it will be hard to say no. It is expected to be fast, correct, simple, fair and also inexpensive to file and to process. It's OK for taxpayers, but it provides a huge boost to our entire nation.

That only includes taxpayers' waste of time, but consider also time it takes to process so many million forms by 80,000 IRS employees ... it is all entirely wasteful and it should be revised as soon as we can.

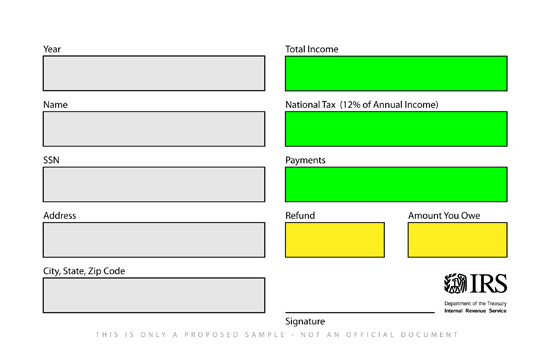

Tax Return

We have mentioned many advantages of the National Tax system, here is it main form that may have to be used.

Here is the first proposed version. No we did not forget anything and this is not a joke. If the National Tax system goes through its paces and becomes approved, this is all the government may need from its taxpayers.

This paper form includes identification of the taxpayer, year for which this is filed, taxpayer's total income, taxpayers National Tax calculation (here it is 12% of the income), tax payments that have already been submitted and refund or amount taxpayer owes. That's it! No complications, deductions, etc.

More Form Explanation

- Taxpayer knows itself, name, address, they may look up Social Security Number, but the first part is done in a few seconds.

- Total income should also be easy, it is mostly submitted to taxpayer by their employer. It should also include how much money has already been contributed.

- Income percentage – which is the total tax – is the only math on this form. This example shows 12%, so if your income is $40,000, 12% is $4,800 and that is your National Tax.

- If Payments is larger than your tax, you will be receiving a refund, if Payments is smaller than tax, you need to include the remaining payment. If your tax is $4,800 and you have already paid $4,200, your remaining tax payment is $600. If your tax is $4,800 and you have already paid $5,000, your refund is $200.

- Sign it, ship it and you are done. Or file it online or call IRS tax return number and you are done as well.

And the form may not be needed. Most taxpayers will choose to file taxes via internet or telephone. If you wish to know, internet or telephone submission may also be more accurate. Because our proposal calls for IRS to double-check your submitted numbers with numbers it receives from your employers and other sources thus lowering the chance that there is a mistake.

What Is Unfair

Sure, taxes are high, nobody likes that. They are often misused and we don't like it either. The system of collecting taxes, writing rules and laws around it, is so sad it sometimes makes you cry. Overall then it's not fair, and here are a few proposed details that could change it. To give us smarter and more simple system.

Progressive Tax

Progressive tax we have now is not fair. It sounds good and positive, but it's not fair when different people pay different taxes according to different tax rates. It's supposed to be fair and same for all of us, but it's not. In its basis it ensures that richer or higher earners pay higher percentage of tax. It may seem fair to some, but not because they think it is fair, but because they wish others pay more and especially others who happen to earn more money.

Consider the following comparative examples:

- Taxpayer with $60,000 of taxable annual income pays $5,147 plus 22% of the amount of over $44,725 of annual income, so $8,507.50 altogether.

- Taxpayer with $30,000 of taxable income pays $1,100 plus 12% of the amount of over $11,000 of annual income, so $3,380 in total.

- Therefore you can earn 2 times more but pay 2.52 times more. Or half a salary, but only 0.4 in taxes. Fair? No, it may be fair only for people who wish others to be more impacted.

Here is the comparison between two taxpayers and their tax story. One earns $60,000, the other $30,000 or half of the first. But does he pay half of the taxes? The first taxpayer owes $8,507.50 in taxes, while the second owes $3,380.00, and it is not a half, it is 0.4 or 40%. If he had to pay the half, his tax bill would have been $4,253.75, but it is just $3,380.00.

The next columns show the same taxpayers with proposed National Tax with 12% tax percentage. The first taxpayer owes $7,200 and the second taxpayer owes $3,600. Half the income, half the tax. Fair.

National Tax Numbers

Try to calculate and how does it compare

to current Federal Tax.

The numbers above are for single filers, not for married filers filling jointly. And of course this is United States and so most all of us also have to pay state tax and many other taxes.

This current tax system encourages folks to cheat on their returns, lie on their forms, pretend that they did not know about this or that and simply pay as little as they can. It encourages higher earners to seek the tax help to minimize their tax return and it's not always fair and straightforward. One very important effect of our existing tax system is also that our citizens do not always look for a better job with more income and encourages some smaller businesses to often pay employees less but under the table so less becomes more.

Complexity Of The System

Our system is very complicated due to its lack of simplicity. It makes it very possible for people to cheat on taxes or make mistakes or file the tax without properly knowing how to do that. Most people need tax attorneys, tax accountants, qualified and educated help and then they pay the tax (sometimes) and pay their helper too. Very unfair.

Complexity of our system also requires tremendous amount of work on the other side, tax collection agency IRS. It does not take 2 minutes to check incoming tax return, it takes much more and often hours. The agency employs about 80,000 employees ... and it does not include separate jobs by accountants, attorneys and more who taxpayers often need. IRS annual budget is now about $14.3 billion or $14,300,000,000. How much citizens spend completely is hard to estimate and publish, but the number which includes everything has to be astronomical.

Expenses

Income taxes contribute about $2.35 trillion. Another $1.59 trillion comes from payroll taxes including $1.10 trillion for Social Security, $342 billion for Medicare, and $55 billion for unemployment insurance. For your information, 1 billion is 1,000,000,000 (1 thousand millions), 1 trillion is 1,000,000,000,000 (1 million millions), those are incredibly large numbers.

Approximately 153 million people in the USA are taxpayers (this number may have to be updated). The average income tax amount per taxpayer is about $16,207 per year. Very large number. $1,351 per month, $312 per week or $44 per day. Average annual income is about $46,000 ...

New Ideas

We often hear about new ideas that may serve to improve the system, but very often they are worse. One recent example was to eliminate income tax completely and replace it with one federal sales tax. According to that we would not have to go through the hustle of income tax forms, complete them and send them to the IRS, our individual tax would be paid by collecting the federal sales tax. This would however mean that the current sales tax percentage would go up. And it would also collect tax mostly from people who spend a lot, it's a sales tax, and that's not fair either. Another opposite of benefit would also be completely raised prices on most goods and we all know that raised prices affect poor citizens much more than others. Taxes would also be added to current non-taxed items such as food and imagine that our poor citizens would also go hungry.

How Could It Be Fair?

Fair system is not difficult and could be enabled easily and quickly. To establish system that would be fair it only needs to insure that every one of us would pay the same part of income as the tax and to make it even less difficult it would need to keep the calculation process very easy and without any complex math. If you see our form example, the simplicity is all there.

To keep it fair by having the tax same for everyone we would simply need to establish one income percentage as the tax. For example if tax were set to be 10% of income, one would need to find out their income, calculate 10%, and that would be the tax. This system would have no deductions or conditions for different people, it would simply be 10% of the income. If 10% is not sufficient, we could choose higher percentage, 12, 15 or 17% for example. It is also important to consider the amount new National Tax would save to taxpayers and to the country. We won't need 80,000 IRS employees, we won't need hundreds of tax forms, we won't need to spend 13 hours on average per each taxpayer. So a lower tax may be a serious possibility too.

Even National Tax could be made more simple. Imagine that each employer would have to file employees' annual income to the IRS and they would have to do it digitally. IRS would already know what was everyone's income, they could compare it with your citizens' tax return and have very precise control of everyone's tax documents. Digital or electronic is much easier and faster to handle. And if our tax return deadline moves from April 15th to January 5th, it would not be a huge surprise.

One other benefit could be brought up.

That benefit would be less IRS employees. Currently we have about 80,000 people checking our tax returns. This number sounds very silly, nothing is produced, 80,000 people waste our and their own time. The cost to have them employed costs us roughly $14 billion and we could use that amount for much better purposes. Imagine that simple fair tax return with name and income and tax amount would be ready and filed in 3 minutes by all of us, it would be processed digitally, mostly checked and compared with employers' numbers digitally as well, and we would be done in couple of afternoons. This could be handled very well and we would not need 80,000 employees and $14 billion to supervise it.

Simpler and more fair system could of course be handled with paper forms delivered by mail or collected through the local IRS offices. That however is more complicated to file and to check by IRS. With current internet network it would be very easy to file electronically and make it easy to prove who you are. And in complete security and privacy. When internet is not available, data can be collected via phone or mail as the backup option. Folks who do not have computers or access to the internet would also have the second option available.

Perhaps we need a different individual code for every person, but it may be that social security number is good enough for all of us. The system may need some extra verification that the code was entered correctly and that it exists, so perhaps new numbers need to be issued and distributed with some unique algorithm. That is a minor problem, we will be able to do that very quickly.

Summary

Three Simple Improvements

- Simple tax return for all

- Same fair tax percentage for all people

- Simple tax return filing

Benefits For All

- Less effort to file tax return

- Faster effort to file taxes

- Easy tax return checking

- Less IRS employees

- Massive savings of time

- Extreme savings for the country

- Other countries may copy our system (I don't mind)

Benefits For The Country

- More fair taxes will bring people together, taxes will no longer be dividing us.

- Poorer citizens may have to pay more taxes, but it will encourage them to earn more and live with more responsibility.

- Rich people will have it more difficult to cheat on their tax returns and be proud that people get more together.

- Nation will benefit by collecting taxes without much of usual supervision, less employees will be a huge advantage and having citizens more content will be good for all.

Disadvantage

- IRS employees need to find more productive jobs – it can be challenging at first but it will confirm current tax system is not needed for many reasons.

- Tax accountants and attorneys need to find other extra work options.

- Loss of income for supporting businesses, such as post office and mail, paper suppliers and stores.

- Initial acceptance of tax returns via phone or internet may have a few initial expected glitches, but the benefits are so large that they will have to be solved very quickly.

- Some politicians may not like it for short period of time, but others will become heroes.

- Implementing tax change will take good effort and major focused energy from politicians and tax workers.

Does It Make Sense?

It depends on who you are, but for us it's a huge “yes”, it does make sense. If it does not for you at first, read this more and give it some positive thoughts and I believe you will find it good for the country and for our citizens. I bet we all may find our current tax system too complex, silly and even un-american.

We still have to run all available numbers and rules to make sure we have 100% promising proof versus folks who may be against this. It's a challenge and also an honest task to introduce such proof that will be clearly calculated and will make it more difficult to stand against the new National Tax. Benefits are never ending and I hope to prove and explain them.

We will always be grateful for your feedback, pros and cons. Thank you.

This proposal makes a huge sense to people who understand it, who understand the benefits of such new system and who also consider the current system unfair and too complicated. If it is that for us as the individuals and citizens of this country, it may be true, but it also means that it is very unfair for our country. It collects taxes and uses them for many expenses the country has, and so the existing system is also bad economically, it works against this country and its people.

It does make sense although perhaps we might be able to come up with even better system. Advantages of this proposal are to simplify the system and make it fair for everyone, so all it needs is details and agreement from our leaders to establish it … and some nice new name :)

Clean, Accurate, Correct, Universal ... or Federal, National, USA Tax. We have many more options we could use, but switch away from 1040 would be great. For us and the country.

This proposal would like to be the first serious step to make it better. This short introduction is also only an overview, more details will make its introduction better. It will be frequently updated and supplied with more details, numbers, objectives and ideas. We already have a very complete picture of all the details it should have, but we will be happy to collect more info and advice from all people who want to join.

Personal News

- Internet Never Works at Riverview

- Spam Samples - See What We Get

- Chimp - Welcome!!!

- Avoid Covid, Avoid Riverview in Vermont

- Leaders with Highest Death Toll

- Avoid Riverview and Covid in Jeffersonville, Vermont

- National Tax System Proposal

- GO Game Results Table

- Crossword Moving Forward!!

- Short News & Updates

- Reduction Of Human Population Size

- Be Like Russians

- English Language

- Is TV Okay?

- Aquarium Notes

- Reset Food Supplies

- End Nuclear Weapons

- Invasions by Russia (Russian Fed, Soviet Union)

- Avoid Advertising

- Trump Process

- Electrical Vehicles & Energy Issues

- Soccer World Cup in History

- Ukraine & Peace

- About Russian (Soviet Union) Invasions

- Russian (Soviet Union) Invasions since 1917

- Aviation Phonetic Alphabet

- Geography

- Benefits of Crypto - Negatives Too

- Math

- Coding

- Quickly Improve in GO

- Aviation Phonetic Alphabet

- Aquarium

- Birdhouse (under dev)

- Accept PayPal or and Venmo for business

- Accept crypto currency for business

- Accept payment online and safe

- Encryption

- Import and Export Products Cost Too Much

- Religion and Lies

AMByte News

- beVermont Completed and Live!

- Company Vision

- AMBYTE Sitemap

- AMBYTE Logo

- Random Password Generator

- Passwords and Memory

More

AMBYTE Vermont, USA

Dec 21, 2024 - Day 356 of this year